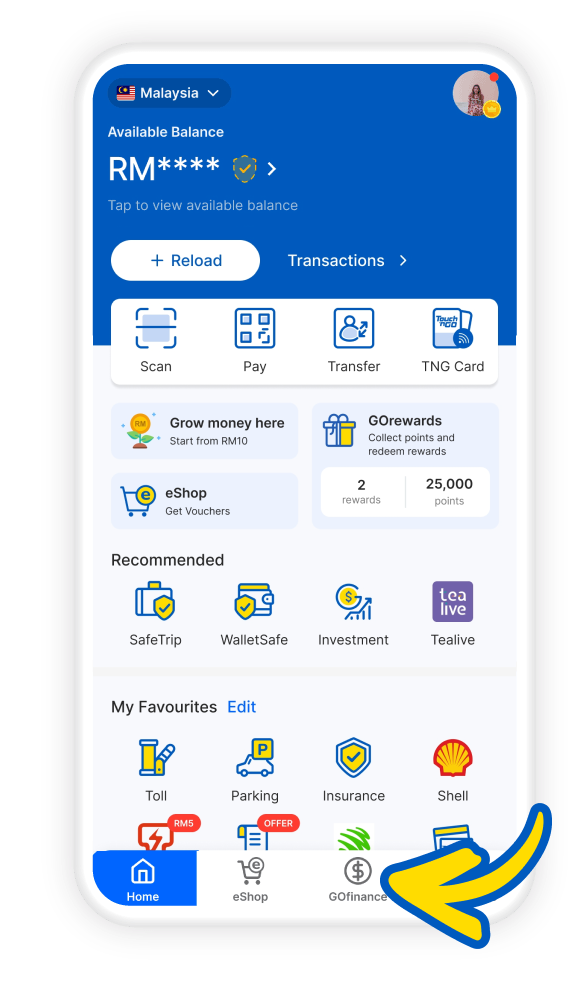

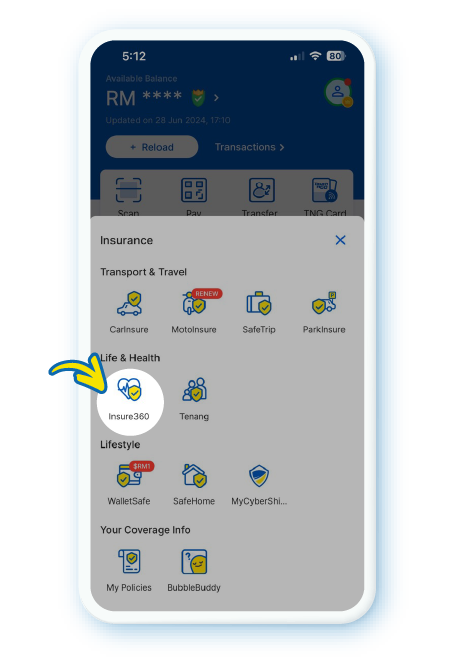

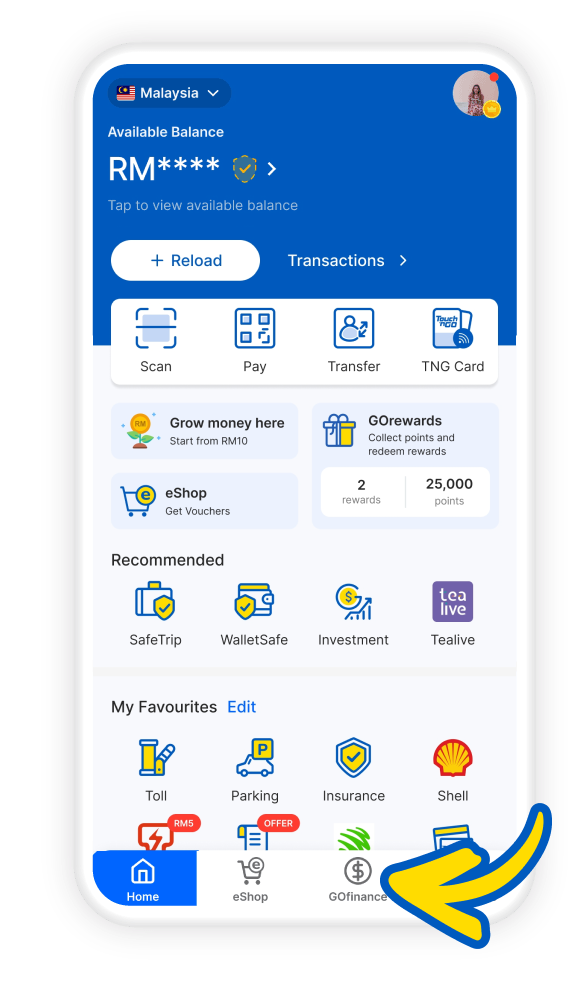

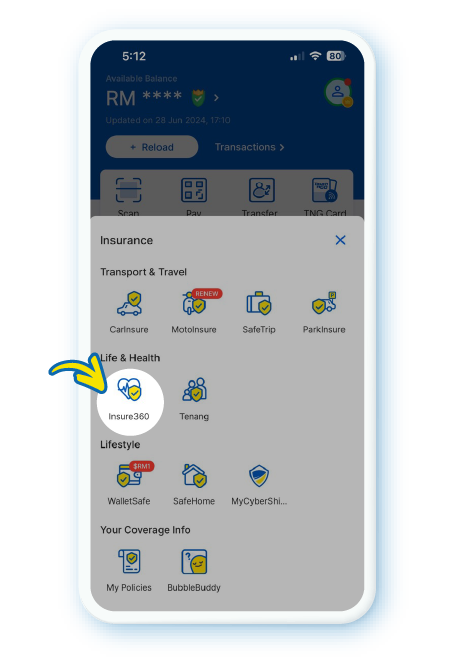

Prioritise your health above everything else with Insure360

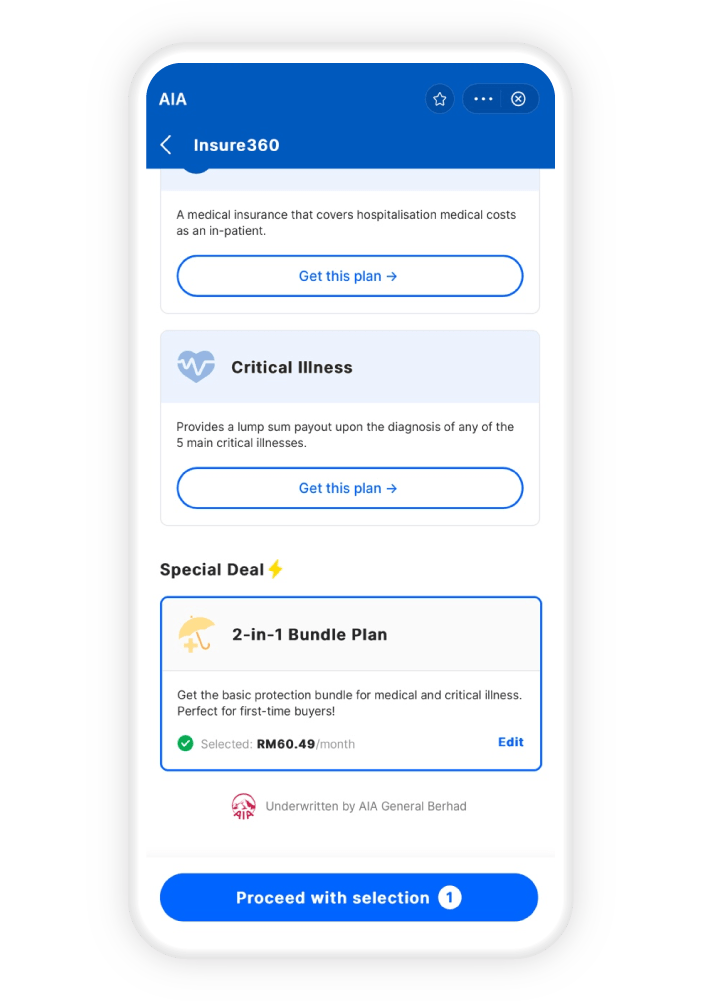

Affordable medical & critical illness insurance plan, customisable based on your needs.

Affordable medical & critical illness insurance plan, customisable based on your needs.

Health insurance is like a financial safety net for your medical needs. You pay a regular amount, also known as a premium, and in return, the insurance helps cover the costs of your healthcare. When you go to the doctor, get prescriptions, or need hospital care, your health insurance kicks in to share the expenses. It's a way to protect your wallet from unexpected medical bills, ensuring that you can access necessary treatments without breaking the bank. Health insurance varies in coverage, but its main goal is to support you in maintaining your well-being while easing the financial burden associated with healthcare. It's like having a financial partner that has your back when it comes to staying healthy.

Provides a lump sum payout upon diagnosis of advanced stages of the Top 5 critical illnesses (cancer, heart attack, stroke, kidney failure and serious coronary artery disease). This extra layer of protection also helps cover expenses such as rehabilitation or lifestyle adjustments.

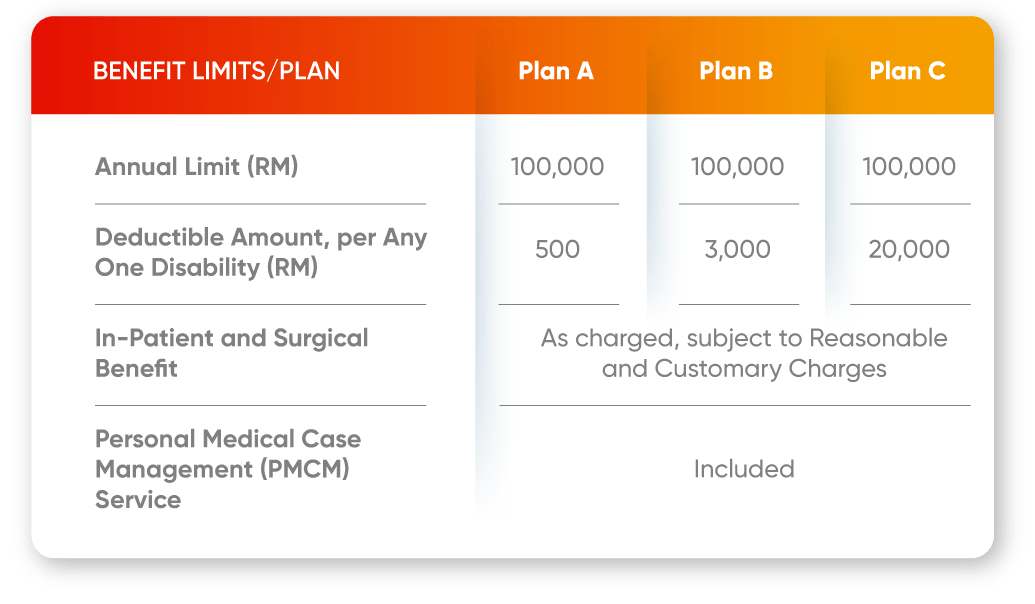

Covers hospitalizations expenses, ensuring access to necessary treatments without straining your finances.

A. Critical Illness plan only

B. Medical plan only

2-in-1 bundle plan (Critical Ilness & Medical Insurance)

Ideal plan for first time insurance buyers

Need help understanding insurance terminologies?

Click here

Insure360 is underwritten by AIA General Berhad (A PIDM member). The benefit(s) payable under eligible product is protected by PIDM up to limits. Please refer to PIDM's TIPS Brochure or contact AIA General Berhad or PIDM