Touch 'n Go eWallet Anti-Bribery and Corruption Practices Policy

OVERVIEW

Anti-Bribery and Corruption Policy is a reference document of TNGD on policy matters relating to the prevention of bribery and corruption in our organization to ensure TNGD conducts its business conforming to the highest level of integrity and ethics and all employees comply with the relevant laws and regulations on anti-bribery and corruption.

The policy represents TNGD’s stance of zero tolerance to bribery and corruption and serves to protect the company from financial and reputational loss as a result of regulatory and/or enforcement, censure and action.

The objectives of this Policy include:

sets out responsibilities of TNGD’s employees and associated persons working for and behalf of TNGD, in observing and upholding its position on anti-bribery and corruption and comply with this Policy and applicable laws and regulations at all times;

provides information and guidance to those working for and on behalf of TNGD as described in section (i) above, on how to recognize, raise a concern and deal with bribery and corruption issues.

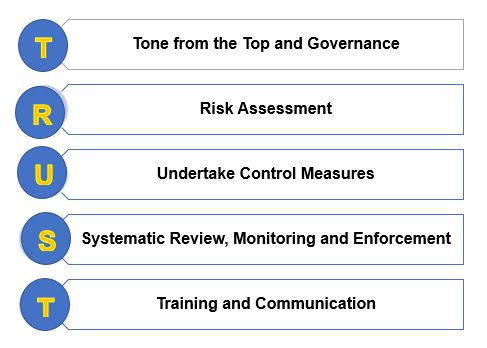

establish standards and guidance for TNGD’s employees to understand and comply with the requirements and obligations imposed under Malaysian Anti-Corruption Commission Act 2009 (MACC) Act 2009 and Guidelines on Adequate Procedures issued pursuant to subsection (5) of Section 17A of MACC Act 2009, which include amongst others, the five guiding principles under TRUST:

For a full copy of our ABC Policy, please click here

For a full copy of our ABC Policy, please click here

RESPONSIBILITY FOR THE POLICY

The TNGD Board sets the tone at the top providing leadership and support for the Policy. TNGD Management is responsible for the Policy's implementation and its effectiveness within their business units including communication and training activities to ensure every employee understand and comply with this Policy.

PENALTIES FOR OFFENCES RELATING TO SECTION 17A MACC ACT 2009

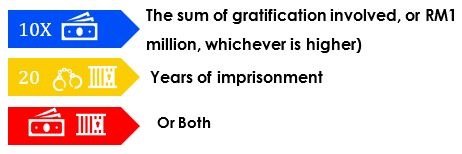

Engaging in bribery and corrupt practices is a criminal offence in Malaysia under the MACC Act. Any participation in bribery and corrupt practices, if found guilty, may be subject to imprisonment up to 20 years and/or a fine of not less than ten times the sum or value of the relevant gratification, or RM1,000,000 whichever is higher.

All employees and associated persons are responsible for full adherence to all relevant requirements and will be held accountable for any failure to adhere to the requirements, and may be subject to disciplinary action up to dismissal or termination of business relationship (wherever applicable) including enforcement action by enforcement authorities.

All employees and associated persons are responsible for full adherence to all relevant requirements and will be held accountable for any failure to adhere to the requirements, and may be subject to disciplinary action up to dismissal or termination of business relationship (wherever applicable) including enforcement action by enforcement authorities.

ANTI-BRIBERY AND CORRUPT PRACTICES STANDARDS

Gift, Hospitality & Sponsorship

The following exceptions to this rule may be allowed under the following circumstances:

Gifts during festivals to selected valued clients;

Exchange of gifts during official events, signing ceremony or company visits to a group of employees;

Promotional items;

Gifts of nominal value with company logo;

Gifts to external parties with no business dealings, e.g. charitable organizations

Notwithstanding the above, the following shall not be allowed:

Giving of cash or cash equivalent (such as traveler’s cheques, coupons, gift certificates or cash vouchers).

Where a conflict of interest situation may arise, e.g. given whilst a bidding is in progress, expectation of quid pro quo and breach of any law.

Entertainment

As a general rule, a reasonable amount of entertainment is allowed for purpose of business networking, fostering relationships with external parties or showing hospitality. This includes both receiving and giving of entertainment.

However, it shall not be allowed if a conflict of interest situation may arise, e.g. given whilst a bidding is in progress, expectation of quid pro quo and breach of any law.

Facilitation Payments and Kickbacks

TNGD does not make, and will not accept facilitation payments or “kickbacks” of any kind by any of its employees and associated persons. Facilitation payments are typically small, unofficial payments made to secure or expedite a routine government action by a government official.

Donations

TNGD only makes charitable donations that are appropriate, legal and ethical under local laws and practices.

RISK ASSESSMENT & CONTROLS

TNGD adopts a risk-based approach in managing its bribery and corruption risks. All lines of businesses (LOB) and support functions are required to conduct risk assessments on a periodic basis.

All business and support functions must identify areas of their business that maybe prone to bribery and corruption risks and establish controls to mitigate risks identified and validate on a regular basis that the controls are effective and performing as intended. All risk assessments must be duly documented and available for review.

MONITORING, REVIEW & DUE DILIGENCE

TNGD recognise that managing an anti-bribery and corruption programme is a continuous process and a systematic review and monitoring process is necessary to ensure its objectives are being met. Internal control systems and procedures will be subjected to regular review to ensure the effectiveness and compliance to the anti-bribery and corruption programme and policy.

Proper due diligence must be conducted on any relevant parties or personnel (such as Board members, employees, agents, vendors, contractors, suppliers, consultants and senior public officials) prior to entering into any formalised relationships. Methods may include background checks on the person or entity, a document verification process, or conducting interviews with the person to be appointed to a key role where corruption risk has been identified.

TRAINING & COMMUNICATION

Our employees will be provided with regular Anti-Corruption and Bribery compliance training programmes to educate them about the requirements and obligations of anti-bribery and corruption laws and this Policy.

For successful compliance of this policy, we will ensure continuous efforts to communicate, train and educate all our employees and associated.

RECORD KEEPING

TNGD must keep financial records (together with relevant supporting documents) and have appropriate internal controls in place, which will evidence the business reason for making or accepting payments or gifts to or third parties.

All accounts, invoices, memoranda and other documents and records relating to dealings with third parties, such as clients, suppliers and business contacts, must be prepared and maintained with strict accuracy and completeness.

No accounts must be kept “off-book” or considered “off-record” to facilitate or conceal improper payments.

HOW TO RAISE A CONCERN

Our success in combating all forms of bribery and corruption hinges on everyone’s commitment to adhere to this Policy. Therefore, it is the responsibility of all employees and associated persons to promptly report any suspected contraventions of this Policy. Any employee or stakeholder may raise a concern via email to whistleblowing@tngdigital.com.my. Please refer to the procedures set out in the Whistleblowing Policy made available here for guidance.

Any report made will be treated with utmost confidentiality. No employee or associated persons acting in good faith will suffer adverse consequences to his employment or retaliation for reporting or for refusing to engage in prohibited conduct, even if such refusal results in loss of business opportunities to the Company.