Your step-by-step guide to smart investing with GOfinance

Investing can often feel overwhelming, especially if you’re new to investing and not sure where to start. GOfinance makes it simple and accessible for everyone. It is designed to make your investment journey straightforward and accessible, because everyone deserves a chance to secure their financial future without the hassle.

Let's walk through how you can start smart investing today, regardless of which investor type you are.

-

Investing on a budget

One of the biggest myths about investing is that you need a lot of money to get started. With GOfinance, you can begin investing with as little as RM10. This low entry barrier means that anyone, regardless of their financial situation, can start growing their money.

Add a little more each month and over time, these small investments can accumulate and grow, thanks to the power of compounding. For instance, if you invest RM50 every month, by the end of the year, you would have invested RM600 that could bring potential returns.

-

First-time investors

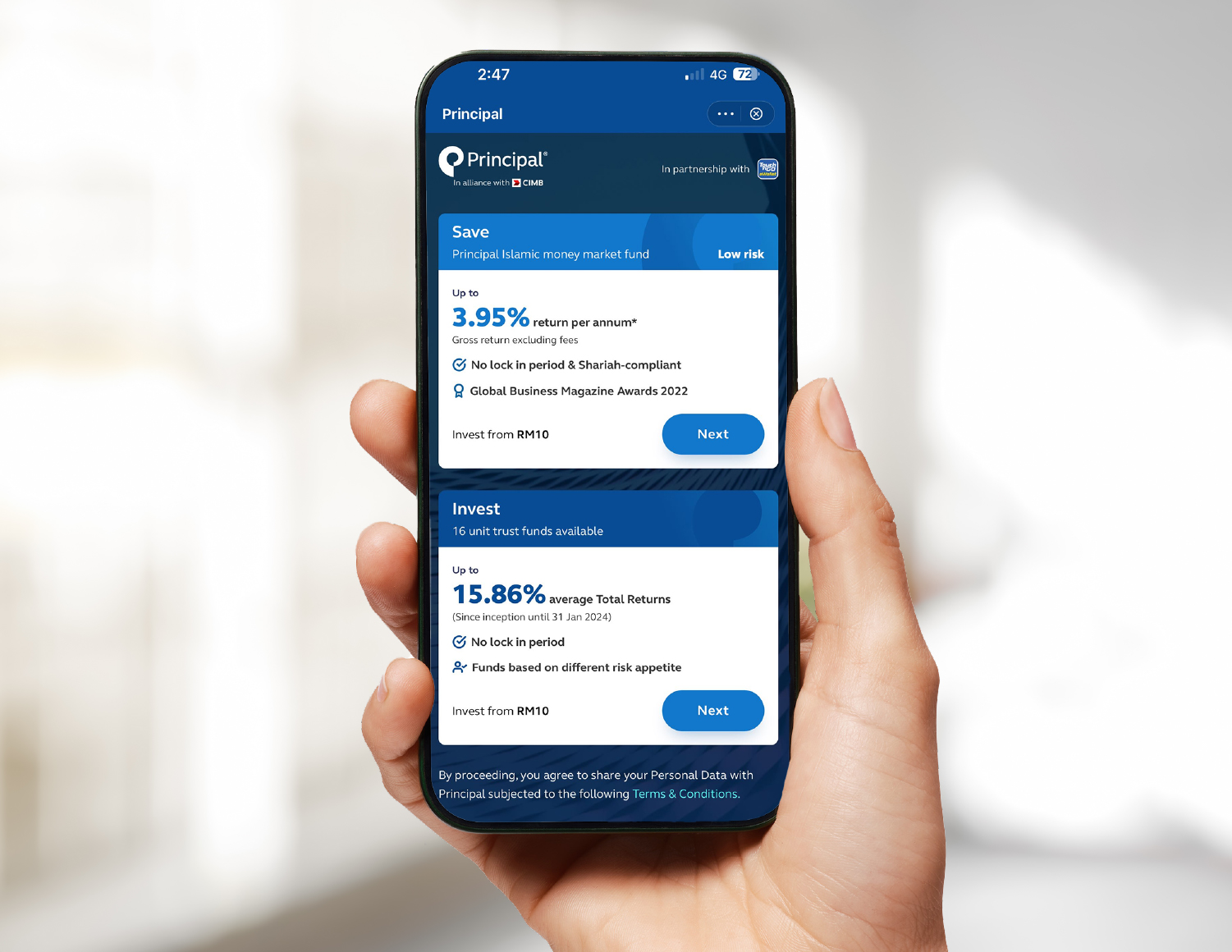

GOfinance is designed with beginners in mind. The platform is incredibly user-friendly, making it easy to navigate even if you have no prior experience with investing. Plus, you can invest with confidence knowing that your money is managed by experts through partnerships with reputable firms like Principal Asset Management, ASNB, and CIMB. This ensures that your investments are secure and professionally managed.

Types of investment

-

Unit trust: A smart start

Unit trusts are a popular choice for many investors, and a more popular investment option for beginners to start their investment journey. But what exactly are they? Simply put, a unit trust pools money from many investors to invest in a diversified portfolio of assets, such as stocks and bonds. Benefits include:-

Diversification: Your money is spread across a variety of assets, reducing risk.

-

Expert management: Professional fund managers handle your investments to maximise returns and minimise risks.

-

With GOfinance, you have the option to invest in unit trust through funds managed by Principal or ASNB. What truly sets us apart is the absence of a lock-in period for a select suite of funds under Principal, empowering you to have full control over your investments and make decisions that align with your financial goals. We are also the first and only platform that allows you to register to invest in ASNB through a fully digital process.

Choose from a variety of unit trusts that suit your risk tolerance and financial goals. By investing in unit trusts with GOfinance, you can enjoy the benefits of diversification and professional management without needing to become a financial expert yourself.

Gold investment with e-Mas: A safe haven

Gold investment with e-Mas: A safe haven

Investing in gold has long been seen as a safe investment. With e-Mas, you invest in gold without the hassle and risk of buying and storing physical gold. Benefits include:

· Easy investment: Purchase gold from as low as RM10 through GOfinance hub.

· Stability: Gold often retains its value over time, making it a stable investment choice.

· Zero fees or hidden charges: There are absolutely no fees or charges for buying or selling gold through TNG eWallet! We believe in transparency, so you can invest in gold without worrying about hidden costs.

Investing in gold through e-Mas is straightforward and offers a secure way to add a stable asset to your investment portfolio.

Why invest with GOfinance?

-

Convenience

GOfinance brings all your investment options to one place. No need to juggle multiple platforms or accounts – manage everything from your eWallet. It's simple, straightforward, and accessible wherever you are. -

Low entry barrier

You can start investing in any of our available products with as little as RM10. This low entry point makes it easy for anyone to begin their investment journey without significant upfront costs. -

Expert management

Our investment products are managed by experienced professionals who ensure your investments are optimised for growth. You can invest confidently, knowing that your money is in good hands.

Ready to take the first step towards building your financial future? Explore GOfinance’s investment options today and start your journey to smart investing.