4 common misconceptions about TNG eWallet's overseas transaction conversion fee explained

Making overseas payments can be a hassle even in today's digital age, especially when it comes to comparing and understanding currency exchange rates as well as conversion fees. Recent news of TNG eWallet’s introduction of the overseas transaction conversion fee may have sparked curiosity among many of you. Let's dive into the details to shed light on this matter.

Misconception #1: TNG eWallet is the only one charging this fee

Contrary to popular belief, the 1% conversion fee isn't an extra expense. Instead, it is a standard practice among most financial institutions in Malaysia, incorporated into daily exchange rates. TNG eWallet has previously subsidised this cost to encourage transactions abroad, and the introduction of this fee aligns with industry norms.

Misconception #2: TNG eWallet has more hidden fees now

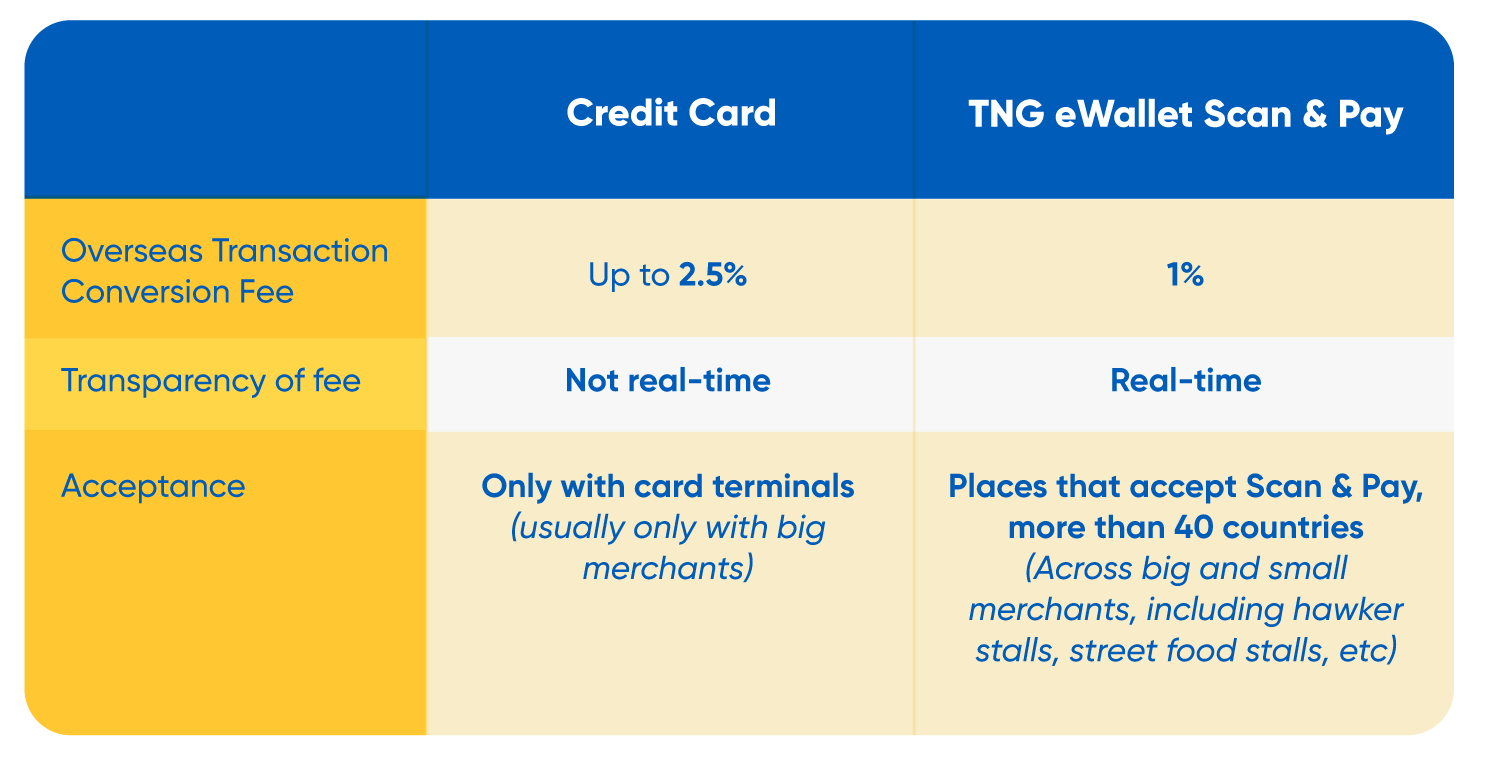

How often have we been shocked by our overseas expenses a month after returning from holiday, only to find surprises on our credit card statement? Well, rest assured there won’t be any nasty surprises with TNG eWallet when you spend abroad. You'll have clear visibility of your expenses right within the app instantly.

The international Scan & Pay feature on your eWallet displays real-time exchange rates, including the 1% fee for increased transparency, which enables you to make informed decisions. Despite the fee, TNG eWallet remains competitive, offering one of the lowest rates in the market.

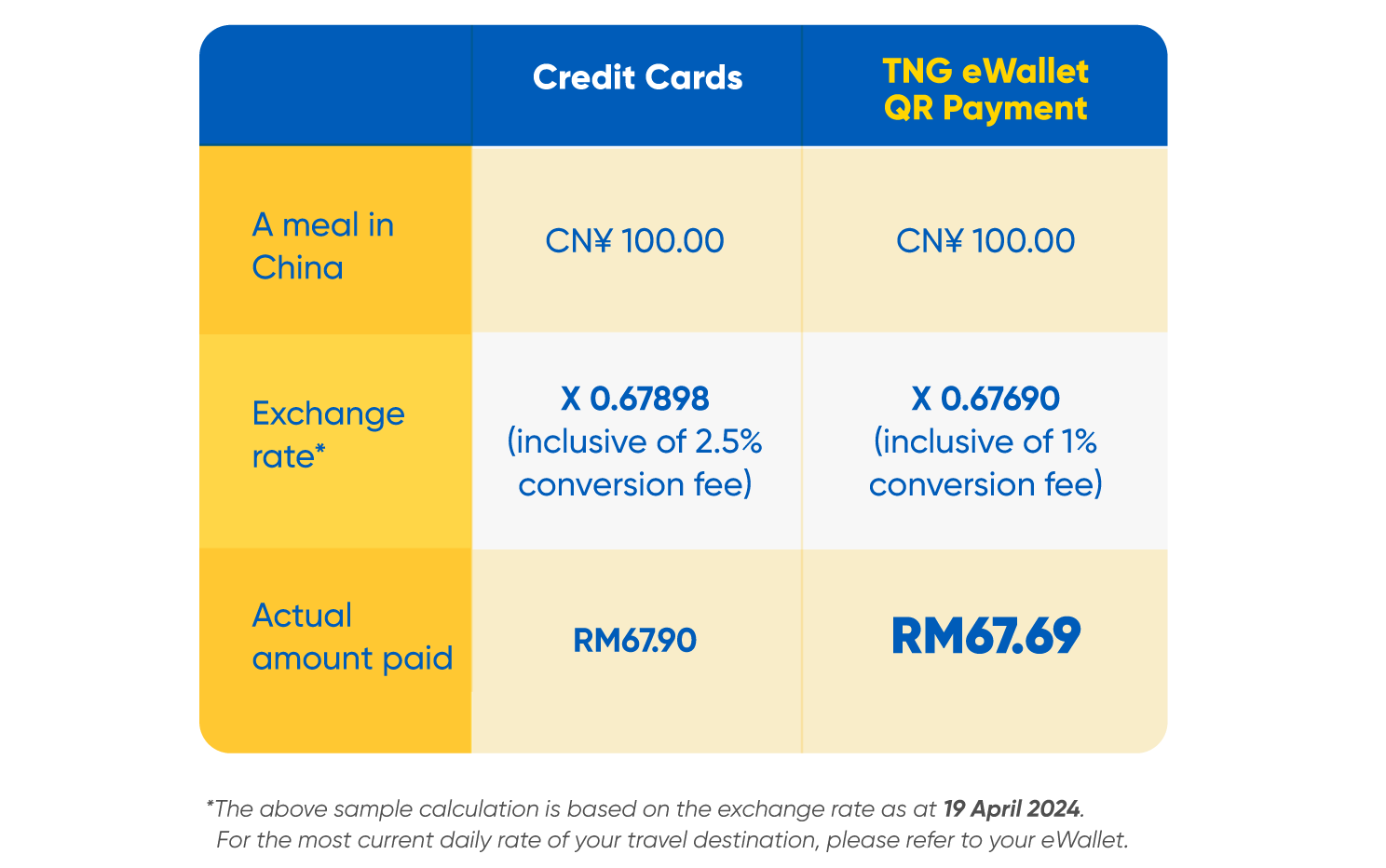

Misconception #3: It’s too expensive to use eWallet overseas now

Because the 1% overseas transaction conversion fee is incorporated into the exchange rate, the resulting difference in the amount is almost negligible. Here’s how it is calculated:

Misconception #4: This 1% fee is applicable to Touch ‘n Go eWallet Visa card too

The 1% fee DOES NOT apply to Touch 'n Go eWallet Visa card. Users of the Visa card continues to enjoy a 0% foreign exchange conversion fee or mark-up, making it an attractive option for international transactions.

Don't let the 1% overseas transaction conversion fee deter you from using TNG eWallet abroad. With its Scan & Pay feature accepted at over 40 countries and a low conversion fee rate, it remains a reliable travel companion. Keep your adventures budget-friendly and hassle-free by relying on your eWallet for overseas transactions.